Safe Alternatives to Cash Lady Loans: Find Your Best Option

- If Cash Lady won’t lend to you, Payday Loans Online is a fast alternative with easy-to-qualify short-term loans from $300 to $1,500.

- Cash Lady is a broker that shares your data with lenders, which can lead to unwanted marketing and unclear loan terms.

- Payday Loans Online is a direct lender that funds your loan directly, keeps your data private, and provides instant decisions.

- You can get a short-term loan of £300 to £1,000 within an hour, with no early repayment fees and full support throughout.

If you’re facing a sudden expense such as a broken boiler, vet bill, or car trouble, you’re not alone. Every day, thousands in the UK feel the pressure of having to find money fast. It’s hard to know who you can trust, especially when you spot brands like Cash Lady. At Payday Loans Online, we want to make borrowing clear, quick, and safe so you get help when you need it without extra stress.

Why You Might Want an Alternative to Cash Lady

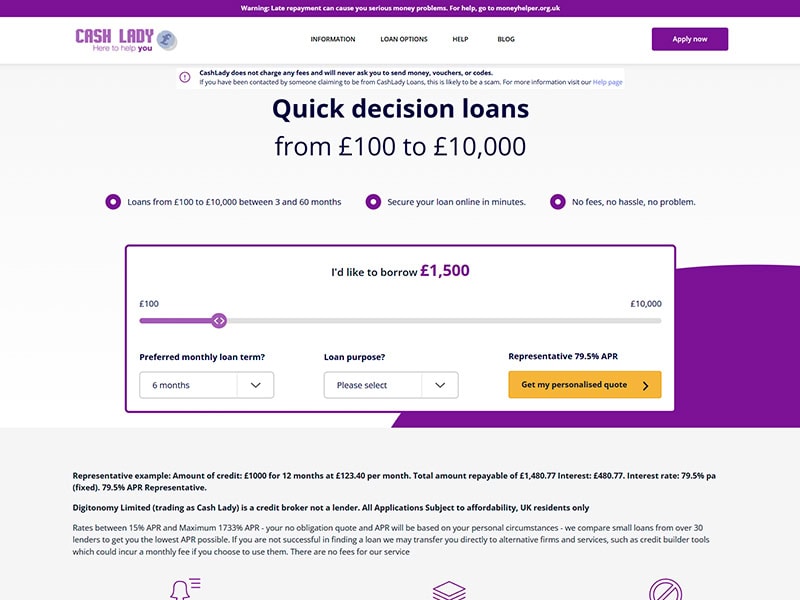

Cash Lady isn’t a lender; it’s a broker. They take your application and pass it to a panel of lenders, earning a commission if your loan goes ahead. That model can mean:

- Faster decisions but less clarity about who you’re borrowing from.

- Your data being shared with unknown third parties.

- Potential for marketing calls or emails from multiple sources.

Reviews reveal a mix of opinions:

- Quick and easy, according to Josh Mullin on April 17, 2024.

- Absolute garbage. They simply pass you on to lots of rubbish lenders, said Robert Sims on March 26, 2023.

Their Trustpilot average is just 2.8 out of 5, with about 54% one-star reviews. This shows how mixed people’s experiences are.

TIP: I have found that borrowers often receive unwanted calls after using a broker. If you want to protect your privacy, check whether your data will be shared before you apply.

Who We Are and Why You Can Trust Us

At Payday Loans Online, we operate a direct-lender model:

- We fund your loan ourselves with no middlemen involved.

- FCA-regulated, we follow the strict rules set by the Financial Conduct Authority.

- Transparent in every detail, we show all fees and repayment dates before you agree.

- Fixed short-term loans let you borrow between £300 and £1,000, with repayment over 3 to 6 months.

- Fast service, you can apply in minutes, get a decision instantly, and receive funds within the hour.

- Real customer support means you can reach us anytime without dealing with automated systems.

We believe borrowing should be straightforward, respectful, and supportive.

Direct Lender vs Broker: What You Need to Know

| Feature | Cash Lady (Broker) | Payday Loans Online (Direct Lender) |

|---|---|---|

| Loan funding | From third-party lenders & varies | Loan funded by us directly |

| Loan amount | Depends on lender | £300–£1,000 |

| Application speed | Fast, but depends on lender | Instant decision |

| Funding speed | Varies by lender | Within the hour |

| Early repayment | Depends on lender | No fees, even if you choose to repay early. |

| Data confidentiality | Shares to lenders | Your data stays with us |

| Trustpilot rating | Rated 2.8 out of 5 on Trustpilot, with mixed feedback from users. | Rated 4.1 out of 5, with clear and consistent reviews. |

| Support throughout | Can pass you on | We help you from start to finish |

How to Apply

- Visit our website. It’s secure and simple.

- Fill out a short application, including your income and outgoings.

- Receive an instant decision with no delays.

- Get your money within an hour if approved.

- Repay early or on time with no penalties and no stress.

TIP: I always recommend having your income and regular expenses written down before you apply. This helps you avoid borrowing more than you can safely repay.

Responsible Borrowing Tips

- Only borrow what you need, not a penny more.

- Review your total repayment before accepting.

- Set reminders so you don’t miss your payments.

- Repay early to save money. It’s allowed and encouraged.

- If you hit difficulties, contact us. We can support you and FCA rules require it.

Need more support? Money Helper and Citizens Advice are there to help.

TIP: I have seen many people benefit from setting a calendar reminder for each payment date. This small step helps you stay on track and avoid extra charges.

Where This Leaves You and Your Choices

In stressful times, dealing with multiple lenders and unclear terms only adds to anxiety. Payday Loans Online offers you:

- A one-company solution with no passing around.

- Fast, transparent borrowing with clear terms and fees.

- Real-life support, not automated responses.

Ready to Make a Safer Choice?

- Do I want same hour funding from a direct lender?

- Need clarity on fees and terms before agreeing?

- Prefer a team that’s here to help from start to finish?

If yes, you’re in the right place. Apply now or get in touch. We’re here to support you. You’ve got this.

Application and Approval Process FAQ

- Who can apply if I used Cash Lady before?

Anyone aged 18+ living in the UK, with a regular income and bank account. We consider all credit types. - Is my information shared?

No. Your data stays with us unless you consent otherwise. - How fast is the decision?

Usually within minutes. - When will I get the money?

Funds are typically in your account within the hour if your loan is approved. - Can I repay early?

Yes, and you’ll save on interest. No fees ever.

Kelly Richards is a UK finance writer with over 18 years of experience in personal credit. She founded the Cashfloat blog and now leads content at Payday Loans Online, where she focuses on helping readers make informed, confident borrowing decisions. Kelly holds a finance degree from the London School of Business and Finance.