Swift Money loans alternative

Searching for a Swift Money alternative? Try PaydayLoansOnline today!

Are you struggling to come up with the cash for an unexpected expense? A broken washing machine, perhaps. Or a failed MOT. Or simply a family emergency. Up and down the UK, many households are experiencing the same financial difficulties. Now more than ever. Who can you turn to in times of need? At PaydayLoansOnline, we understand your situation perfectly. We have already helped thousands of customers just like you.

But what makes PaydayLoansOnline a suitable alternative to Swift Money? Are there any differences between the two companies? What can we offer that Swift Money can’t? We provide an honest and thorough comparison of the two, giving you all the information you need to make the best decision.

What is a Swift Loan?

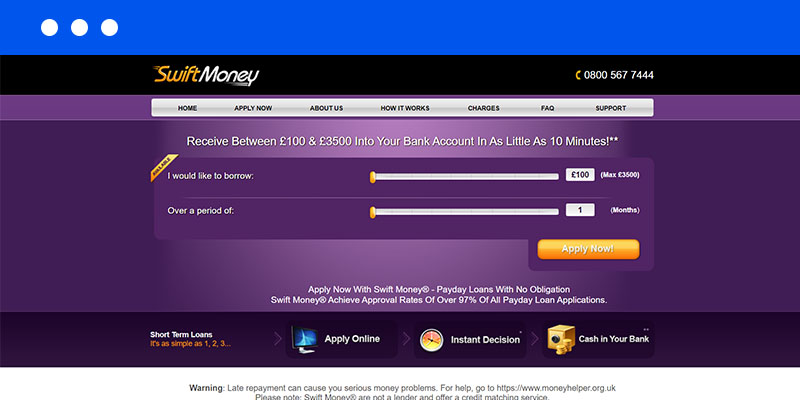

Established in 2011, Swift Money focuses on speed. With swift applications, instant responses and fast funding, the brand offers express short term loans, ranging from £100 to £3,500 for periods of one month to two years. Sounds pretty good, right? Well, yes, it does. Although this fails to set them apart from competitors, most online lenders supply the same service. At PaydayLoansOnline, applications take less than three minutes, and most approved loan requests are transferred in less than an hour.

Swift Money reviews

So, do the company deliver on their promises? One of the best ways to research a loan provider is through online reviews. While all opinions are subjective, they can give a good idea of whether a brand is worth considering or should be avoided at all costs. On Trustpilot, PaydayLoansOnline has over 100 reviews, with a current rating of 4.1. However, Swift Money has only received four reviews, all of which are poor.

Is Swift Money a direct lender?

Aside from our customer ratings, this is arguably the most significant difference between ourselves, as direct lenders, and Swift Money, who operate as brokers. Not sure what that means exactly? Let’s explore the two.

Direct lenders: This form of service keeps everything in house. We process your request. We transfer your money. We are the only people you deal with throughout your experience. As such, borrowing a payday loan from direct lenders only grants the following benefits:

- Simple application and instant responses: We are the only ones assessing your request, so we can approve or deny without waiting for any third parties.

- Easy communication and more privacy: If you have any problems, you can contact us directly. With a broker, your details are shared across two companies, and you may have to switch between the two when issues arise, which can create confusion.

- No fees: Brokers may not ‘charge’ fees upfront, but their service isn’t free. So the commission they receive from a successful connection has to come from somewhere.

Brokers: Companies such as Swift Money work on behalf of customers to find a suitable loan from a pool of lenders. Advantages can include:

- Efficiency: Your loan request is submitted to numerous parties in one go, effectively increasing your chances of approval. With a direct lender, if you are rejected, you will have to start the process again with a different credit provider. However, at PaydayLoansOnline, if you give us your permission, we can act as a broker on your behalf if we are unable to accept your application.

Can Swift Money transfer loans without a credit check?

Credit checks are an essential part of processing any loan application. Many lending services have collapsed into administration after failing to cope with mis-sold loan complaints. Those that survived had to make significant changes to ensure every loan granted could be repaid. Any company claiming no credit check loans is illegal, as this is an actual necessity under the FCA’s regulations. Swift Money, just like PaydayLoansOnline and other reputable businesses, performs a credit check on every application.

However, that shouldn’t put customers with a poor rating off. In fact, we specialise in lending to those who have no or bad credit. As well as a credit check, we will look at other factors when considering your request. If you’re unsure about your chances, why not try our affordability calculator first for a free and zero impact assessment?

What else do PaydayLoansOnline offer?

As well as our position as a direct lender who can deliver the best payday loans quickly and securely, there are several other reasons why our customers choose us and rate us so highly. These include the following.

- We are ethical and responsible. No small print, no hidden fees. We remind all potential borrowers that payday loans are expensive and should only be considered as a last resort.

- Clear totals, flexible payments. You know exactly how much you will have to repay before you sign up. We offer a convenient Easy Start feature to make things even more accessible.

- We help avoid spiralling debt. Our strict no rollover, no multiple loan policy helps protect you from a never-ending cycle of debt.

- We actively encourage you to repay early. No settlement quotes, no early repayment costs. Save money by clearing your debt as quickly as possible.

- Our customer service is always on hand. Dedicated and friendly team members are waiting to answer all your questions and resolve any queries via email, live chat or telephone.

Frequently Asked Questions about Swift Money loans

To make an application, you need to be a UK resident with a UK bank account, be at least 18 years of age, and receive a regular source of income.

The lack of reviews on Trustpilot doesn’t necessarily signal a disreputable company. If you’re looking for alternative opinions, simply run Swift Money through a Google search to see what others are saying about their service.

Good question! Trust is an important issue when any finances are involved. We are FCA authorised and regulated, are upfront about all our loans and charge no hidden fees. Check out what past and existing customers think of us, and feel free to give us a call if you have any doubts at all.